EFile your Income Tax and Benefit Return (Ontario)

Welcome to Buckchart! We offer a Full Service T1 Tax Prep service via online drop off. Near paperless process. No need to leave the house. If interested, please e-mail customerservice@buckchart.com. We'll send you an intake package with instructions to our tax practice management system.

Registered Clients: For Client Centre Access please sign in or use the mobile application provided in the invitation. Contacts: customerservice@buckchart.com, call /text 1 (866) 252-4278 (BKCHART) or schedule online!

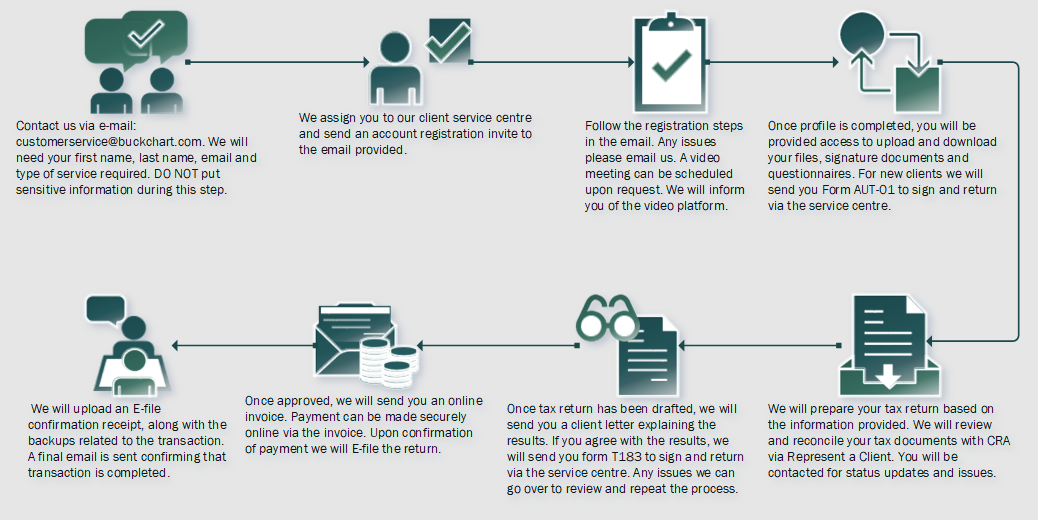

Process Overview

Please note we do not schedule in-person appointments. Please do not e-mail tax documents to us. You are not allowed to submit tax documents on behalf of someone unless you can provide a Power of Attorney. We will provide separate accounts for each client that needs to file a return.

Why use our service?

- Take advantage of our system! Open an customer account with us to securely upload your slips and documents necessary to include with your tax return.

- We use an enterprise-grade tax practice management system that enables:

- secure file transmission;

- online billing and payments;

- customer account management.

- Securely access to your tax files with multi-factor authentication from within your registered account.

- We use an enterprise-grade tax practice management system that enables:

- We will prepare the tax return and efile it for you! Compare us against other Full Service offers.

- We have access to one of the most comprehensive tax libraries in the industry to help us prepare your personal income tax returns.

- We are registered as an Electronic Filer and use EFile certified tax preparation software.

- As an Electronic Filer, we have access to E-services for tax preparers that help us better understand your particular tax situation.

- Simple and transparent pricing structure.

- For most returns we bill a flat fee. If it is really simple, we can price match on best offer. Talk to us.

- For sources of income and deductions that are not on income slips and require more time and expertise, we charge a flat fee plus a per hour charge after the first hour of preparation.

- Collaborate with us using end-to-end encrypted video meetings.

- We can file as far back as 10-years if necessary. We will paper-file tax returns not eligible for EFile.

- We can file for new residents to Canada.

- For the self-employed, agency workers, independent contractors, workers on commission, we can help with documenting your financial transactions for your tax return.

- Free consultation! General inquiries are welcome via e-mail through customerservice@buckchart.com

Reasons to file a tax return

- expecting a refund / balance owing:

- If you have no income, an information return allows you to get your GST/HST credits and other applicable government benefits. In general if you don't file you don't get benefits for the year.

- You need to carryover tuition credits and other similar carryforward amounts.

- Pending repayments: Old Age Security, Employment Insurance, RRSP - Homebuyers' Plan / Lifelong Learning Plan.

- Self-Employed and need to pay balance for Canada Pension Plan.

- If you are a new resident of Canada.

Help us develop our Frequently Asked Questions to help serve you better!

Use our contacts page and use "FAQ: Your Question" on the subject line and submit your question to us. We will tabulate the questions and post it in our Tax FAQ section. Thank you!

Prices in CAD ($)

**We only accept online credit card payments via digital invoice**

Prices charged per tax return per tax year.

We can help find missing tax receipts via E-Services.

Information Only: $2 plus HST

- No Income

- T5007 (Social Assistance)

- T2202A Tuition Receipts

Common: $40 plus HST (From $70) per Tax Return

- All from Information Only plus:

- Child Care Expenses (as applicable)

- Donations / Political Contribution Receipts

- Foreign Income Verification Statement - T1135

- Home Buyer's Plan / Lifelong Learning Plan Repayments

- Income Slips: T4, T4A, T4A(OAS), T4A(P), T4E, T5, T4RSP

- Medical Expense Receipts

- New Residents

- Rent Payments and/or Property Tax Paid - For OTB Benefits

- RRSP Contribution Receipts

- Student Loan Interest Receipts

- T4A - Self Employment (Income only no deductions; already totaled beforehand)

- Tips and Gratuities

- Union/Professional Dues

- Buckchart will review and include all expense deductions and credits as applicable to situation

Regular: $70 plus HST per Tax Return; Time Charge after 1hr: $25 plus HST

- All from Common plus:

- Income Slip: T5008, T3, T4RIF

- Moving Expense Receipts

- Employment Expenses (if applicable)

- Capital Gains / Loss

- Self Employment (Not on a T-Slip and Income only)

- Rental Income (Income only)

- Buckchart will review and include all expense deductions and credits as applicable to situation

Complex: $75 plus HST per Tax Return; Time Charge after 1hr: $25 plus HST

- Includes all Regular items above plus

- Self Employment Income with Expenses

- T4(A) - Self Employment with Expenses

- Rental Income with Expenses

- Foreign Income declaration

- Buckchart to include: review and include all expense deductions and credits as applicable to situation